EDU FAQ #003: How does one understand the RPS budget without exploding in frustration?

You may still explode, but in a milder, less violent way. Teresa Cole attempts to simplify.

Photo by Daniel Novta.

As an English teacher and not a math person, opening up the Mayor’s Amended Biennial Fiscal Plan for 2017 and Richmond Public Schools (RPS) Superintendent Dana Bedden’s Approved FY 2017 Richmond Public Schools Budget resulted in anxiety and panic, paired with big red hives, heart palpitations, and shortness of breath.

Now, I’ve broken it down, in case I’m not the only one who gets overwhelmed.

Before we dig into the dirty details of Mayor Jones’s financial assault on schools (that’s coming in EDU FAQ #004), let’s review the schools’ proposals. Starting from the top…

General Fund vs. Non General Fund: Putting the “fun” in fund!

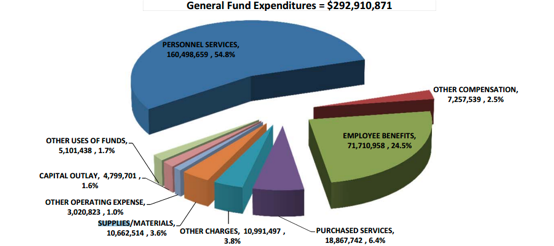

There are two types of funds in the RPS Budget: “General” and “Non General.” The General Fund is the majority of the RPS operating budget, which includes funding from the federal, state, and local governments. In other words, when you hear people talk about the $292 million the school district needs to operate day-to-day operations, they’re talking about general funds.

The Non General Fund includes, well, everything NOT in the General Fund:

- Special revenues, which includes a lot of grants, awards, and donations from various groups and organizations

- Federal revenue funds, which includes all the Titles (I, II, III, IV and VI), plus special education services, corrections and adult education

- Enterprise Funds, which means school nutrition and the Arthur Ashe Center

- Internal Service Funds…read Copy Center

- Non expendable trust funds (I have no clue what this line item is but it is listed as Allen Fund)1

- Agency Funds, which is RPS’s contribution to Maggie Walker and the Math and Science Innovation Center, Governor’s Summer School and Professional Development

The items in the Non General Fund all zero out and don’t affect the gap in funding, so we’re going to focus our understanding on the General Fund and all the fun things it has to offer. And by fun, I mean raging-headache-at-3:00-AM-when-you-realize-your-bills-may-not-get-paid-on-time-fun. Not your kind of good time? Mine either, so I’ll try to make it easy to swallow.

Minding the gap

Bedden’s budget, which was approved by the RPS school board in February, stated that the district needs $293 million to operate in fiscal year (FY) 2017, and they have requested $164 million from the City towards this amount. This was $18 million more than the mayor’s FY16 budget had appropriated to schools, thus creating a “funding gap.”

Think of it like you would your bank account. If your income is less than you spend a month, your bank account goes into the red.

Basically what this gap means is that if City funding doesn’t increase (and as of now, Mayor Jones has said it won’t), the district’s revenue and expenditures won’t add up.

Think of it like you would your bank account. If your income is less than you spend a month, your bank account goes into the red. If the City doesn’t fully fund RPS, their bank account for next year starts in the red.

This doesn’t mean the system goes in debt, it simply means they need to balance their budget, and it means they need to cut $18 million in expenses from their budget for the next school year. The school board and Bedden have already started to talk about what that might look like, including closing several schools in the district, which predictably has parents and teachers less than thrilled.

But why the gap?

The majority is due to the $11 million additional dollars needed to fund mandates and maintain current levels of service. Mandates include federal, state, and local level requirements, for example vehicle insurance and Virginia Retirement System benefits.2

“Maintaining current levels of service” includes such things as software licenses, risk management, security, and operations positions. The remaining gap includes, partly, Bedden’s request for $4.9 million to decompress teacher salaries (which we broke down for you in EDU FAQ #002: What’s all this about teacher salaries?.

Other proposed expenditures within that gap include:

- $2.7 million in unfunded initiatives from FY16, including $1.2 million to upgrade tech at all schools3

- $2.3 million for new resources and positions to implement the Academic Improvement Plan (AIP)

- $1.7 million in capacity building, which mostly includes new positions in student services, grants management, and professional development

If you’re doing the math, you might notice that just the highlights above equal closer to $23 million. Due to some cuts and reductions on the part of RPS, the actual change from last year is approximately $21.4 million, and RPS expects an approximate increase of $3.35 million from the state, which is how the $18 million gap is determined.

To sum up so far…

For the FY2017 budget, RPS has outlined almost $293 million in expenditures versus a projected $275 million in revenue. (see how that checkbook didn’t balance there?). We’re going to break down those two very large numbers in order to better understand exactly what Bedden is asking for and what the mayor isn’t willing to fund. Hold onto your seats, folks.

Where does all this money come from to fund RPS?

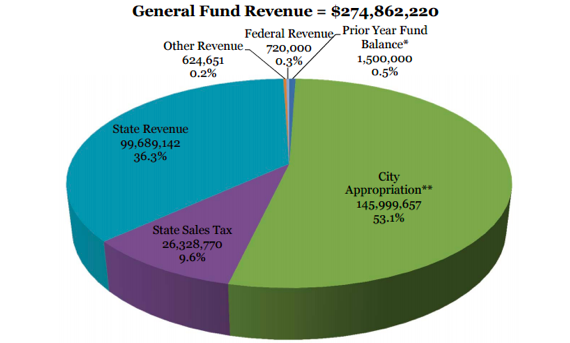

I’m so glad you asked! The Commonwealth and the City make up 99% of the system’s general fund revenue, with only miniscule amounts coming from other funding sources.

The City appropriation is local revenue from the mayor’s proposed budget that will be reviewed, amended, and approved by City Council sometime in May (one hopes).4 State revenue refers to money that comes from the Virginia Department of Education and Medicaid sources and is based on the Governor’s introduced 2016-2018 biennial budget. This paired with the state sales tax equals a total of approximately $126 million, a 2.7% increase from FY16. Other revenue is generated from things like building rental fees and tuition. And lastly, that tiny sliver of income from the federal government includes Impact Aid, Air Force, and Army JROTC programs.5

So, with the bank account loaded up, how does all of that money get spent?

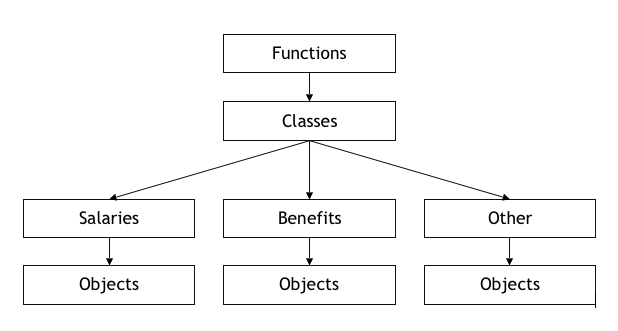

It gets complicated quickly. The basic structure of the RPS budget goes something like this:

There are eight “function” codes which are designated by the Virginia Department of Education (VDOE)–these are actions and activities related to a specific purpose.

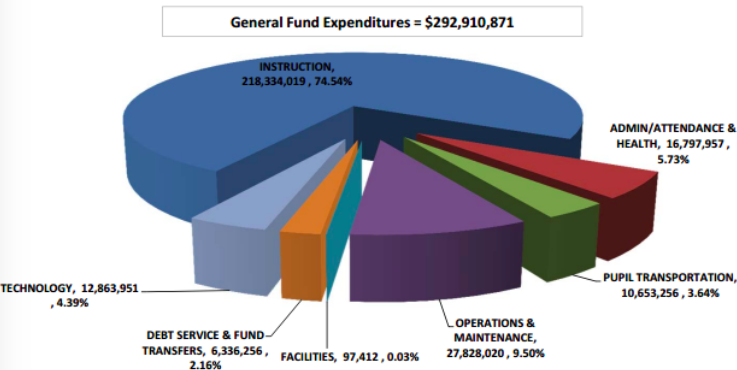

At the State of the Schools address on March 9th, Bedden’s presentation included a graph, similar to the one found in his budget (and shown above) that explains how money is spent in RPS according to the VDOE function codes. Bedden likes to point out that a large portion, 74.54%, goes to instruction.

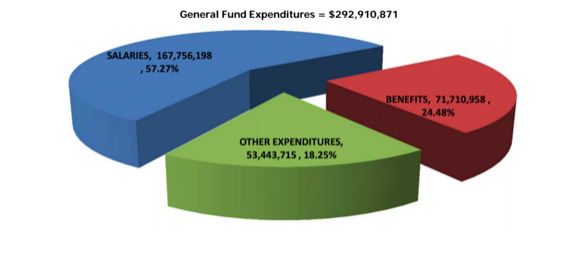

What exactly does “instruction” mean though? In the RPS budget, “instruction” is broken into seven “classes”: classroom instruction, guidance services, school social worker services, homebound instruction, improvement – instructional, media services, and office of the principal. From these seven categories, salaries and benefits account for a very large portion, 89.7%, of that “instruction” piece.6 District-wide, salaries and benefits account for a substantial amount of the budget, approximately 82% of the total $293 million.

If we want to understand where money is going, we need to examine that $53 million in “other expenditures.”7 The budget breaks down the three major groups in the graph above (Salaries, Benefits, and Other Expenditures) into nine objects (see the graph below). Objects are budget accounts representing a specific object of expenditure (something they spend money on).

Beyond salaries (personnel services and other compensation) and benefits, the three largest categories make up a majority of the remaining 18% dedicated to other expenditures.

- Purchased Services: Include, but are not limited to $2.83 million for service contracts,8 $3.6 million for professional services,9 $4.5 million for non-professional services,10 and the big hitter, $6.5 million for tuition11

- Other Charges: The big thing to note here is of the nearly $11 million dollars earmarked for this category, $7 million is utilities

- Supplies and Materials: In this category, 95% of the spending is from supplies, materials and textbooks12

If you aren’t completely exhausted from trying to follow all that, stick with me just a bit longer.

Where do the biggest increases come from?

Now that we understand the basic structure of the budget, where are the biggest increases coming from? If we look at the seven VDOE functions, major increases are seen in technology (32.4%), pupil transportation (14.1%) and instruction (7.65%).

Technology

Bedden has clearly noticed that RPS is light years behind the surrounding counties when it comes to technology integration. This inequitable access only furthers the opportunity and achievement gap between students in RPS and their peers in the counties, many of whom are provided with personal laptops starting in middle school. His budget shows a 400% increase in technology equipment, a $1.5 million increase from the previous year. Additionally, Bedden has asked for an additional $15,000 for staff development, an 800% increase.

Transportation

The big increases in the category are coming from bumps in salary and benefits for vehicle operators and monitoring services (which are seeing a huge 44% increase).

Instruction

A troubling increase in this category is the nearly $200,000, or 30% increase, for homebound instruction, a large portion of which would go to substitute instructional professionals. No other category in instruction has an increase anywhere near this large. Is this indicative of RPS’s larger discipline issues? Could be worth looking into further.

Congrats, you’ve made it!

I’ve just thrown a lot at you, and I know when I dove into this, my brain swam for a couple of days…OK, weeks.

But it’s important to understand what Bedden and the school board say they need to fully fund schools. Hopefully what you’ve just read provides a clearer picture, although, there are still many lingering questions. In the coming weeks and months, everyone will have an opinion about where cuts should happen if the City doesn’t come through with funding. As those suggestions get whipped around and the battle unfurls between the school board, City Council and Mayor Jones, we’ll try to examine them and deconstruct the pros and cons of each. It could be a bumpy ride.

— ∮∮∮ —

WANT TO START AT THE VERY BEGINNING?

It’s a very good place to start!

- From the RPS website: RPS: A Mini History: Bits & Pieces – “State Planters Bank (now Crestar) was appointed administrator of the Otway S. Allen Trust Fund which has been used for the “William C. Allen & Aliaville Allen School of Technology” (various vocational and business-related programs at the Mechanics Institute and the Technical Center).” Crestar was bought by SunTrust in January 2000, so we can’t speak as to how up-to-date this page is. ↩

- If you are anything like me, you might be asking how the federal, state, and local government can mandate something and then not provide the funds to pay for it. The short answer is, you cut the things you can because the mandates have to be funded. My guess would be, by making them part of the “gap,” you hope to pressure local government to fund them. The reality is, when that gap isn’t closed, the mandates aren’t the items that get cut. ↩

- Unfunded initiatives refer to items that were requested in the FY16 budget but were cut when City Council didn’t fully fund the school board-approved budget. Besides technology upgrades, it included athletic equipment and fine arts funding, as well as dual enrollment and advanced placement program offerings. ↩

- The full calendar of events leading to the adoption of a City budget that will in turn fund RPS can be found on the City Council blog. ↩

- This is not that Title I money, or any of the Title money. Remember we said above that that stuff’s in the Non General Fund. ↩

- To be clear, I’m not speaking to whether the positions in RPS are or aren’t necessary, fairly paid (in either direction), or effective. This would require a level of analysis we don’t have time or space for in this particular article. Let’s save that for another day, m’kay? ↩

- Looking to that “other” category does not negate the fact that there may be places to cut staffing in that salaries. ↩

- Maintenance contracts on computers, vehicles, copiers, office equipment, instructional equipment, and annual software service agreements. ↩

- The cost of legal, medical, dental, audit, psychological, speech therapy, and other professional services. ↩

- Computer service providers, tutorial support, triennial census, agency instructors, REAP, drug testing, background and fingerprinting costs, claims administration fees, annual garage services, and athletic trainers. ↩

- Tuition is money paid to other divisions, states and private entities for placement of exceptional education pupils as well as payments to the Maggie L. Walker Governor’s School, the Appomattox Governor’s School and the Math Science Innovation Center. ↩

- Supplies and materials refers to instructional, consumables, duplicating, office, janitorial, medical, linen, uniforms, computer software, testing, library, and repair and maintenance supplies. Textbook allocation is for replacement, maintenance, and new adoptions. ↩

-

Recommend this

on Facebook -

Report an error

-

Subscribe to our

Weekly Digest

There are 9 reader comments. Read them.