A 2014 spending pie

Did you keep your fork? Because there’s more pie!

I’m back with more pie!

I should say that my goal for this column is not to show you how great I think I am at personal finance, or to tell you the best way to handle your money. Instead, I hope to give you a peak into another family’s finances. Personal finance is such a taboo topic that often we go our entire lives without seeing how other people approach the same problem we all have: how to pay for life. Even our parents don’t always let us in on the family finances when we are kids. All we see are the things people have. Given that’s all we have to go on, no wonder we compare ourselves to each other and try to catch up in the wrong ways. Imagine if we could park our savings rate in the driveway. “Honey, the Joneses are saving 20 percent of their income. I sure would like to be able to do the same.” Sighhhhh, a personal finance junky can dream.

So please keep in mind as I walk you through our family’s 2013 spending that I don’t think you should aspire to these percentages of spending. Heck, I don’t even think we should be spending these amounts in these areas. This is just the culmination of the choices we’ve made at this point in our lives with this amount of income.1

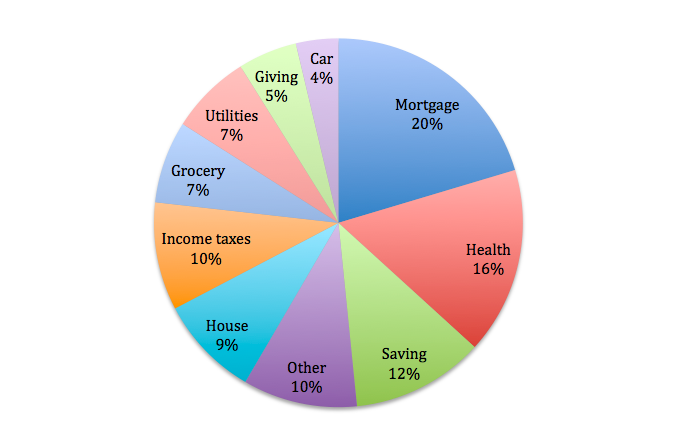

First off, our mortgage. Our mortgage accounted for a full 20 percent of our spending in 2013. I would prefer to spend zero on a mortgage, but 20 percent seems to be within the limits that most financial advisors recommend. So I try not to sweat it too much, and I really like my house.

In 2013 we spent a full 16 percent of our total outlays on health-related expenses. This included our monthly premiums, copays and deductibles. We welcomed a baby last year, which partially accounts for spending so much on healthcare. However, I can tell you that we did not have a baby this year, and our 2014 health spending easily outpaced 2013.

Ah, next is my favorite. Our family saved about 12 percent of the total amount of money that came in. Most of this was passive saving and due to no work on our part–interest and dividends earned on our investments, which was rolled back into those funds without us even seeing the cash. The rest of that saving was plain ol’ planning. Twelve percent is actually pretty low for us. Way back in our wild and crazy 20s we saved a solid 50 percent of our income. It was a lot easier when we had two incomes, zero kids, no mortgage, and our employers covered our healthcare. But now we have these children. We saved so much in our 20s in part because we knew we would be spending a lot in our 30s, what with bringing the little darlings into the world and raising them to be grown up darlings. Even though I buy them used clothes and they play with gifted toys, kids need brand new, name brand health care.

However, if you compare us to the average American household, which saves about five percent of its income, we ought to be celebrating (without spending any money popping bottles, mind you).2 I would be more comfortable if our savings rate was closer to 25 percent, but I’m confident we will get back there one day. And then, BOOM! College for the kids.

Ten percent of our spending goes to a big catch-all category. Included in this slice of the pie is clothing, eating out, entertainment, gas, travel, hobbies, stamps, Christmas gifts, etc. For my purposes, I like to list each of these line items separately, but for the sake of a pie chart you could read, I lumped everything together that was less than three percent into this convenient miscellaneous category.

In 2013 our family spent nine percent of our total outlays on improvements for the house. I include in this category fixing the dishwasher, a new rug, new sheets–all those things that keep our home a place where I’m willing to spend 24 hours of my day. This category of spending was higher than usual last year because we finished up a kitchen renovation. And when we look at our 2014 spending, it will be even higher because of all the work we’ve done on this dang 100-year-old home that I love almost as much as my children.

Another nine percent of our outlays went to Uncle Sam and the lady on the Virginia flag with her boob hanging out. Ouch! Seven percent went to both groceries and utilities respectively. We keep total expenses for food under control by eating at home, but if Mama wants salmon, Mama gets salmon. Plus, we have to keep the babies warm in the winter and cool in the summer.

Five percent of our “spending” was actually giving. I’m ashamed of this, and I think it should be 10 percent. I read somewhere that Angelina Jolie and Brad Pitt give something like 30 percent of their income. But I wonder if that was before she started doing fewer movies…did a hotter couple ever exist? Sorry, I digress. We’ve been slowly ratcheting up our giving for years, but we are obviously still short of the mark.

Finally, four percent of our spending went to transportation. (Not including gas, which has its own category. I included it in “other” because it accounted for only two percent of our annual spending.) We are fortunate in that we own all our vehicles outright. But we still have to pay taxes, insurance, and maintenance on a car, a truck, a motorcycle, and two bicycles. Luckily it all amounted to no more than four percent of our annual outlays in 2013.

Well, that about sums it up. It’s not the perfect budget. I’d prefer to pay less for housing and health care and give and save way more. But life is about choices. My husband and I choose to live in an awesome neighborhood (the Fan!). We also choose to be self-employed and spend lots and lots of time with the little darlings. One day our babies will be grown up, our mortgage will be paid off, and we will again both work full time. Then we can spend all our extra cash on…booze and travel–you thought I was about to get all sappy with that one, huh?

I’m DYING to know how your pie is cut. What is your biggest piece? Where does all your hard earned cash go? Spill it.

Photo by: Didriks

- With a healthy dose of luck-of-the-draw. ↩

- Americans save about five percent of their after-tax income. Full disclosure: my pie is before taxes. Our after-tax savings rate is about 15 percent. ↩

-

Recommend this

on Facebook -

Report an error

-

Subscribe to our

Weekly Digest

There are 2 reader comments. Read them.